Terraform Labs Alleges Citadel Orchestrated Stablecoin Sabotage

- Antwan Koss

- October 13, 2023

- news, Crypto

- Citadel, Stablecoin, Terraform Labs

- 0 Comments

Terraform Labs accuses Citadel Securities of intentionally devaluing its stablecoin, USTC. Legal actions seek trading-related documents during the devaluation.

Key Takeaways

- Terraform Labs accuses Citadel Securities of deliberately devaluing its stablecoin, USTC, in 2022.

- Legal motions are filed, seeking Citadel to produce documents related to its trading actions during the depegging incident.

- Public evidence hints at Citadel CEO’s intention to short the stablecoin during the devaluation period.

- Terraform is concurrently facing a lawsuit from the SEC, alleging involvement in a multi-billion-dollar crypto asset securities fraud.

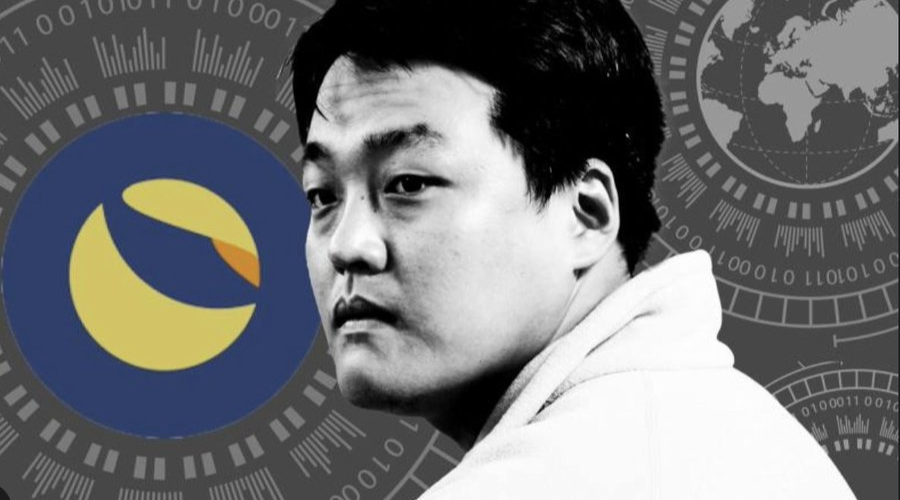

Terraform Labs, founded by Do Kwon, is directing accusatory arrows at Citadel Securities, alleging a “deliberate, orchestrated effort” to depreciate its stablecoin, TerraUSD Classic (USTC), in 2022. The firm has advanced its claim to the legal battleground, filing a motion in the U.S. District Court for the Southern District of Florida, intent on compelling Citadel to unveil documents related to its trading activities during the period when USTC dramatically depegged, plummeting from $1 to a mere $0.02.

🚨TERRAFORM V SEC UPDATE:

TERRAFORM LABS ACCUSES CITADEL SECURITIES OF HAVING A HAND IN THE COLLAPSE OF STABLECOIN $LUNC $UST #LUNA #BITCOIN #dokwon pic.twitter.com/x7W6Od2oAv

— Crypto Macro (@cryptomacro14) October 13, 2023

Terraform Labs Sabotage

Contradicting the notion that algorithmic instability was the culprit behind the stablecoin’s sharp devaluation in May 2022, Terraform maintains a bold stance. The company asserts that the destabilization was not instigated by algorithmic flaws but rather was a result of “certain third-party market participants” deliberately shorting the stablecoin. They argue, “Movant contends that the market was destabilized due to the concerted, intentional effort of certain third-party market participants to ‘short’ and cause UST to depeg from its one-dollar price.”

Adding fuel to the fiery claims, the motion brings into light “publicly available evidence” suggesting Citadel CEO, Ken Griffin, harbored intentions to short the stablecoin concurrently with its depegging. A Discord channel chat screenshot cited in the filing shows a pseudonymous trader claiming Griffin expressed intent to aggressively short Luna UST, invoking the infamous trading strategies attributed to George Soros.

Terraform‘s legal actions seem particularly pivotal given its ongoing battle with the U.S. Securities and Exchange Commission, which accuses the company and its founder of “masterminding a multi-billion dollar crypto asset securities fraud.” Terraform avers that the documents are imperative to bolstering its defense and has requested case transfer to the U.S. District Court for the Southern District of New York if the initial motion is denied.

Concluding Thoughts

The allegations and legal entanglements between Terraform Labs and Citadel Securities weave a complex tapestry in the dynamic world of cryptocurrency. This occurrence underpins the multifaceted challenges stablecoin developers and traders encounter in navigating both market stability and regulatory compliance. While the legal framework continues to unfold, the scenario underscores the critical importance of transparency, regulation, and ethical conduct within the digital asset sphere.

The unfolding of these allegations and ensuing legal battles will be crucial in shaping both public perception and regulatory approaches toward crypto trading and stablecoin management moving forward. It’s not just a battle between two entities but a scenario that might pave the regulatory future and ethical considerations within the rapidly-evolving crypto industry.